Services

Back

Engineering

Build scalable, high-performance software with end-to-end development.

Product Strategy & Innovation

From concept to launch—expert strategy for market-ready products.

Quality Assurance & Testing

Ensure reliability with rigorous testing and quality assurance.

Cloud Engineering

Optimize infrastructure with cloud solutions and automated workflows.

Industries

Back

Fintech

Tailored fintech systems, from digital banking APIs to fraud detection tools.

Education

Custom EdTech platforms for schools, universities, and e-learning innovators.

Healthcare

HIPAA-compliant custom systems for telemedicine, EHRs, and medical research.

Government

Secure, scalable platforms for public services and infrastructure management.

About Us

Back

About Us

Innovative software development tailored to your needs. Meet the team behind the tech

Careers

Join our talented team. Grow your skills in a dynamic, forward-thinking environment.

How we deliver

Agile, efficient and client-focused. See our process from idea to execution.

Partners

Collaborating with industry leaders to bring you cutting-edge solutions.

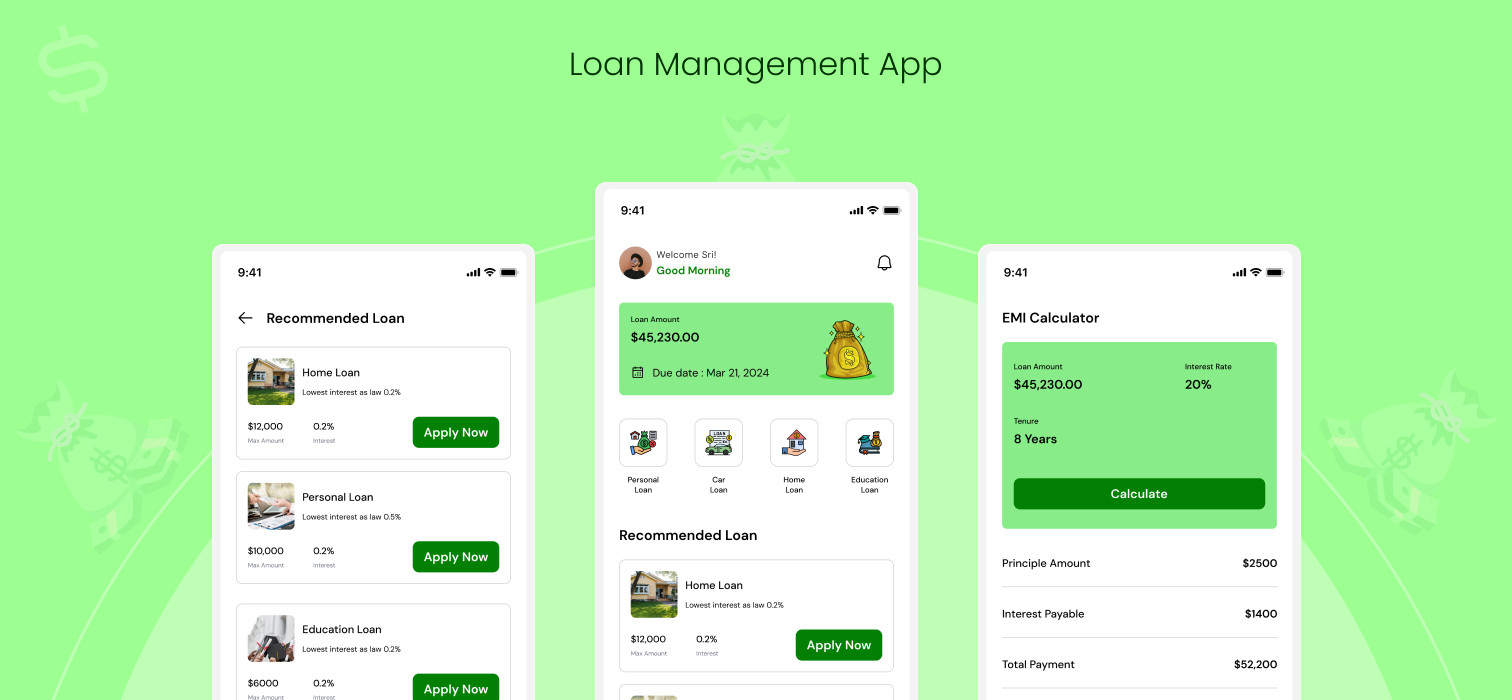

Custom Loan Management Software Development for a Microfinance Company

Overview

Our client is a growing Microfinance company that provides small loans to individuals and businesses that lack access to traditional banking services. With a strong presence in emerging markets, the company aims to offer quick, transparent, and flexible financing solutions. However, their existing loan management processes were highly manual, leading to inefficiencies, delays, and increased operational costs.

Services Provided

Challenges

To overcome these challenges, the company required a custom loan management system (LMS) that would streamline operations, improve risk assessment, and enhance customer experience.

Manual Loan Processing

Time-consuming and error-prone approval workflows.

Limited Risk Assessment

Risk assessment capabilities, making it difficult to evaluate borrower creditworthiness.

Inefficient Loan Tracking

Leading to delayed payments and increased defaults.

Solution

Our team at Idealdevs developed a cloud-based loan management system with a modern and user-friendly interface. The system automates the full loan lifecycle, from application and approval to repayment and reporting.

Key Features Implemented

Borrowers can apply for loans online or through mobile apps. The system automatically verifies borrower details using integrated KYC APIs.

AI-driven credit scoring algorithm evaluates risk and suggests loan terms.

Seamless fund disbursement to borrower accounts using multiple payment gateways.

Real-time tracking of loan disbursement status and transaction logs.

Integration with multiple payment service providers for flexible repayment options.

Built-in regulatory compliance checks for different jurisdictions.

Real-time fraud detection and risk assessment tools.

Borrowers can check loan status, repayment schedules, and transaction history online.

Support ticketing system for customer queries and assistance.

Results & Business Impact

The implementation of the custom loan management system resulted in

60% faster loan processing – from application to disbursement.

40% reduction in operational costs by eliminating manual processes.

25% improvement in repayment rates due to automated reminders and better risk assessment.

Enhanced compliance with automated reporting and data tracking.

Scalable architecture allowing the client to expand into new markets.

Technology Stack

React.js

Vue.js

Angular

Node.js

Python

MySQL

MongoDB

PostgreSQL

AWS

Google Cloud

Azure

Conclusion

By leveraging technology, the client transformed its loan management operations, improving efficiency and customer experience. Our custom-built LMS enables them to scale their business while maintaining compliance and reducing risk.

At Idealdevs, we specialize in custom fintech technologys that help financial institutions streamline operations and drive growth.

GET IN TOUCH

Let’s chat, reach out to us

Have questions or feedback? We’re here to help. Send us a message, and we’ll respond within 24 hours

Start your project with Idealdevs

Fill out the form, and tell us more about your business goals. We’ll get back to you within 1 working days

Would you rather directly get in touch? We always have the time for a call or email!

Orgito Baraj

CEO, FounderIndustries

Technologies

Company

Resources

- Terms of use |

- Privacy policy |

- Sitemap